Private Equity in Football: Investments, Fan Concerns, and Potential Regulations

Private equity in football: is shaking up the game with big investments in clubs. Private equity excites some for the potential growth, but worries others about the sport’s traditions and financial risks. Fans and regulators are grappling with private equity and the changing landscape of footballs direction. Find out more about the opportunities and obstacles.

The world of football is experiencing a major shakeup with the rising influence of private equity firms. These investment groups are pouring money into football clubs, sparking a wave of investments that’s both exciting and concerning to fans and regulators. Fans are voicing their concerns about the potential impact on the traditions and soul of the sport, while regulatory bodies are considering how to navigate this new landscape.

This article dives deep into the phenomenon of private equity in football, exploring the motivations behind the investments, the anxieties of fans, and the potential regulations that could emerge.

Why is Private Equity Chasing the Beautiful Game?

Competing in the Premier League escalates annually, driven by wealthy owners acquiring teams. Even private equity struggles to rival resources like those behind Newcastle United, backed by Saudi Arabia’s sovereign wealth funds. The ultimate goal of private equity firms is to generate a return on their investment.

Private equity firms are drawn to football for several reasons:

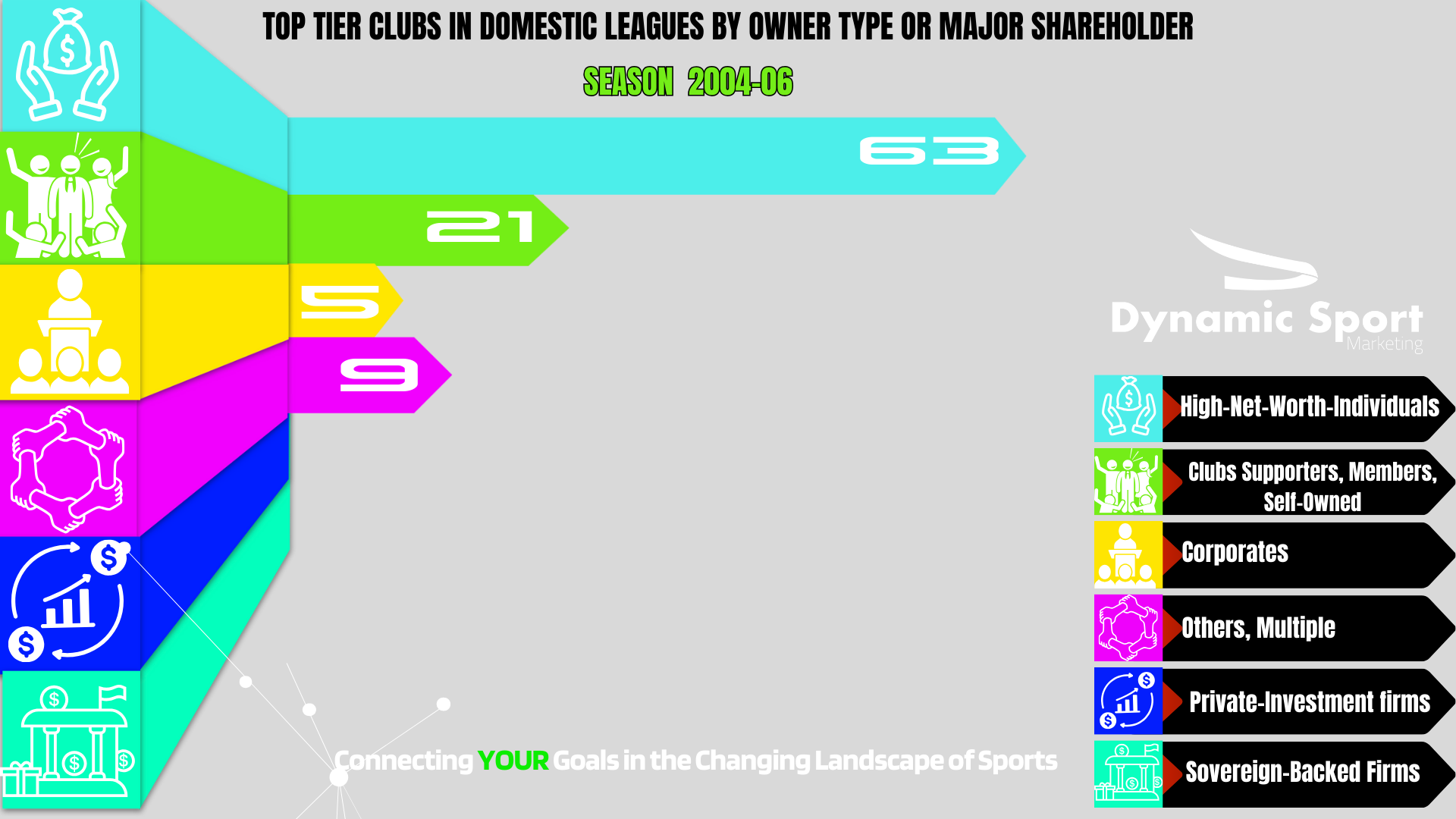

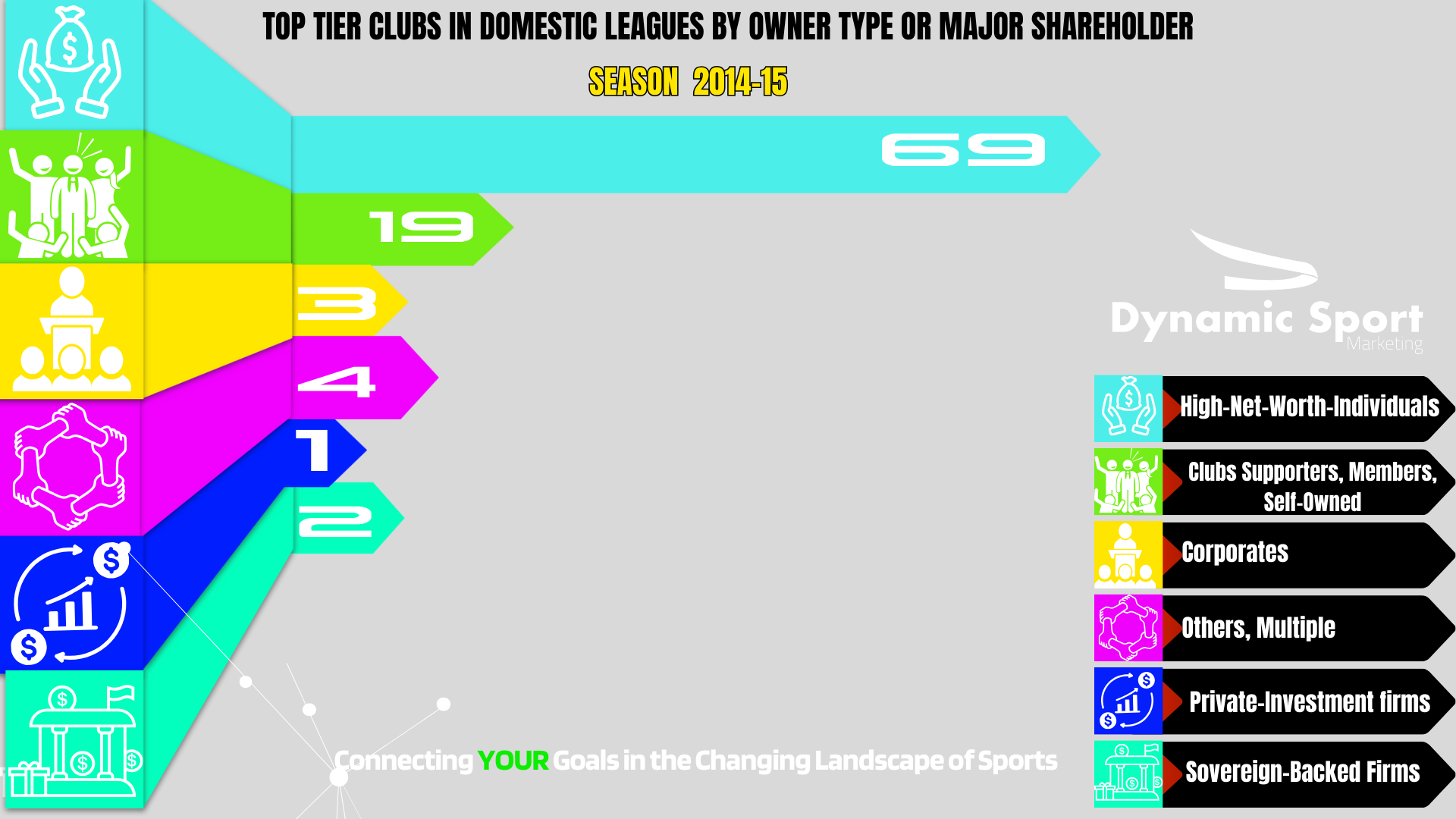

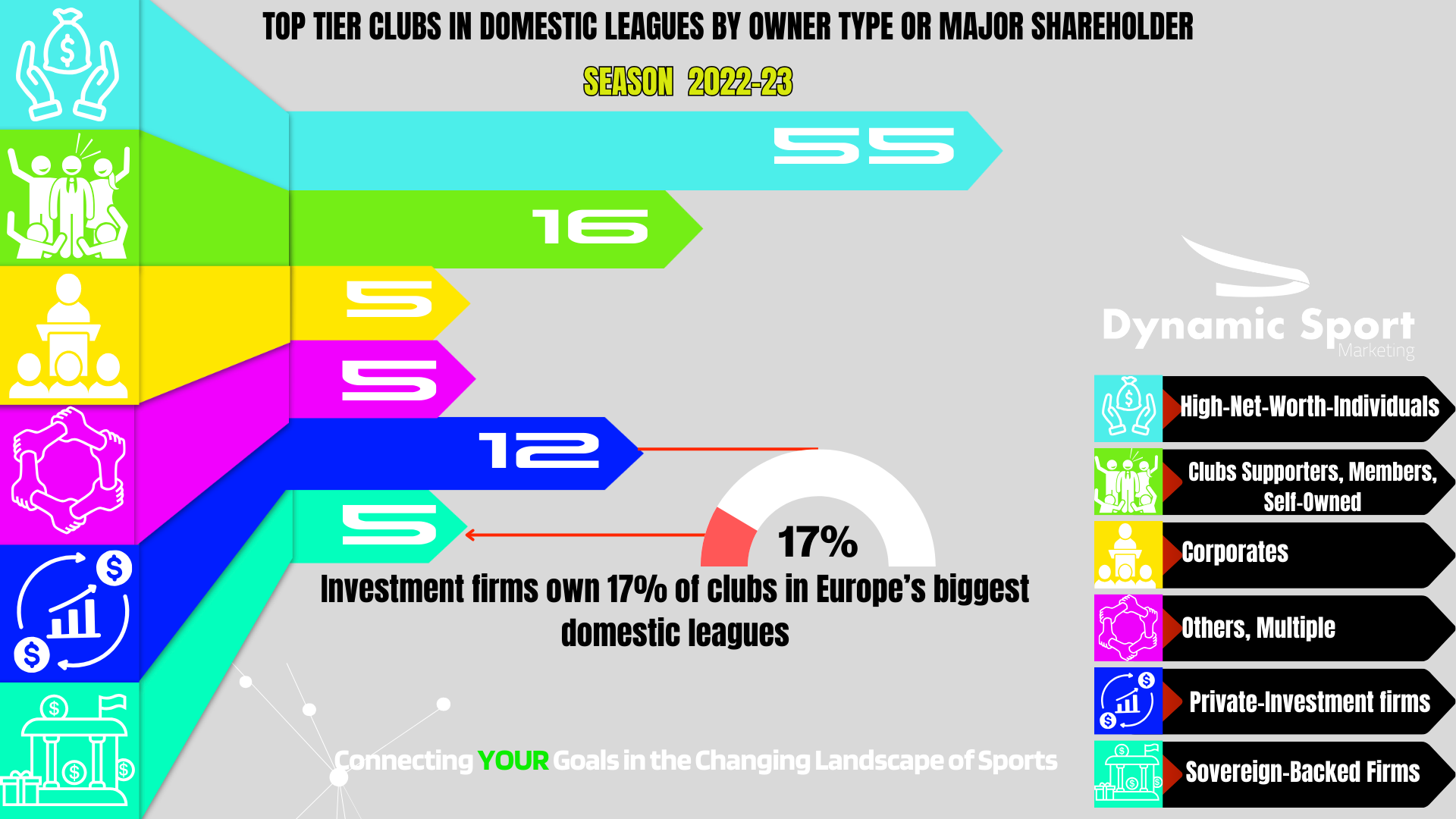

Private investment firms now own or are the major shareholders in 12 of Europe’s top leagues, according to Bloomberg.

- Lucrative Revenue Streams: Football boasts loyal fan bases, driving high viewership, ticket sales, and merchandise purchases. This translates into steady cash flow, attractive to investors.

- €4.9 billion in deals were recorded last year across Europe’s top five football leagues, a significant increase from the €66.7 million in 2018.

- Financial challenges triggered by COVID-19, coupled with the expanding assets under management (AUM) of private equity (PE) firms, have intensified interest in football ownership deals.

- Notably, there’s been a surge in investment from US investors.

- Growth Potential: Private equity firms see untapped potential for maximising commercial activities, sponsorships, and digital engagement, promising significant returns. Private Equity firms see a chance to capitalise on this existing fanbase and tap into new regions through strategic marketing.

- Global Appeal: Football’s international reach makes it a desirable investment, particularly when compared to other sports with a more limited audience.

- Taking the Club Public: A successful Initial Public Offering (IPO) allows private equity firms to cash out on their investment while the club gains access to new capital.

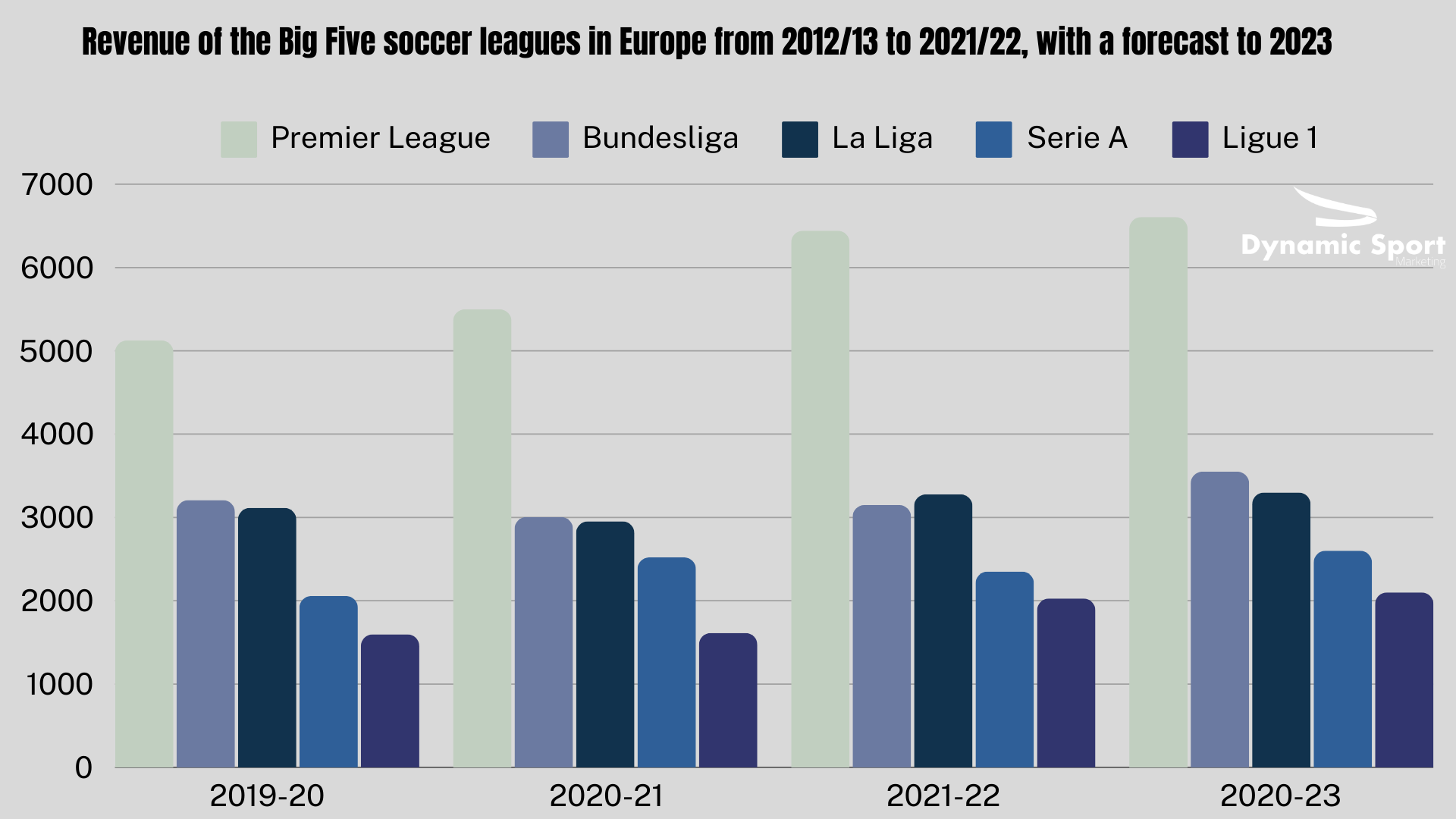

In the 2021/22 season, English Premier League clubs outpaced Bundesliga and La Liga combined in revenue, totaling 6.44 billion euros. Projections indicate a rise to 6.66 billion euros by 2023/24. In contrast, Ligue 1 lagged behind with a revenue of slightly over two billion euros, the lowest among the Big Five leagues.

What’s in it for the Fans

- Private equity investment can boost infrastructure, player acquisition, and club development for fans.

- Expertise in data, marketing, and commercialisation can lead to a more professional and efficient club structure.

What are Fan Concerns and The Role of Regulators?

The influx of private equity isn’t without its critics. Here are some key concerns:

- Private equity’s focus on short-term returns may clash with long-term sporting goals.

- Private equity buyouts can saddle clubs with debt, hindering future spending on players.

- Profit focus can harms fans: higher prices, youth neglect, and traditions ignored.

- Fan fear: 50+1 rule erosion in German football could sever fan-club ties.

The German Conundrum: 50+1 Rule Under Threat?

Germany’s unique fan ownership model, where fans hold a majority stake in clubs, has been a point of contention. While it fosters a strong sense of community, some argue it hinders financial growth. Private equity firms see an opportunity here, potentially pressuring changes to the 50+1 rule. This has sparked protests from fan groups who fear losing control of their beloved clubs.

German fans aren’t alone in their concerns. Similar protests against private equity involvement have been seen in England, over Newcastle United takeover against a Saudi-backed takeover.

The Role of Regulators: Keeping the Game Fair

Regulatory bodies like UEFA’s Financial Fair Play (FFP) are crucial in ensuring financial sustainability and preventing clubs from overspending. As private equity investments grow, regulators will need to adapt to ensure a level playing field and protect the integrity of the sport.

The Final Whistle: A Balancing Act

Private equity investment in football presents a complex picture. While it offers potential benefits, concerns regarding fan engagement, financial stability, and the very soul of the game need to be addressed. Striking a balance between attracting investment and preserving the traditions that make football special is key. While private equity brings fresh capital and expertise, ensuring the long-term health and fan connection of football clubs is paramount.

Stay tuned for future posts where we’ll delve deeper into specific aspects of private equity in sports, exploring success stories, potential pitfalls, and the evolving role of regulators.

#privateequity #football #soccer #sportsinvestment #fangroups #financialregulation

Let’s continue the conversation! Share your thoughts and predictions for the upcoming Champions League season on our social media pages… Links below.

This was a report by Dynamic Sport marketing. Connecting your goals in the changing landscape of sport.

Contact us for support on freelance or a flexible basis if you want to reach sports fans for your brand:

Email us @ Dynamic Sport Marketing Or call us: +31(0) 38 8520831

For a full list of our services click this link for an overview of our easy consulting services

Sources:https://www.bloomberg.com/news/articles/2023-02-17/wall-street-brings-its-financial-engineering-to-english-football-at-chelsea